Personal Insurance

Many people choose to insure their homes, contents and car, but too many Kiwis fail to insure their most prized possessions – their loved ones and their ability to earn!

Questions:

1. What would happen to your family if you were unable to earn an income? How would you pay your mortgage or household expenses (food, power etc.)?

2. What would happen to your family if you suffered a serious illness? Could you continue to provide for your family if you needed Specialist Care?

3. What would happen if you were made redundant? Or got seriously injured in an accident?

Let us help you take the time to work through insurance that will keep your family in your home and protect your two biggest assets: your income and your family.

Did you know?

The covers we can provide are as follows:

Health Insurance

Covers GPs, Specialists and Tests.

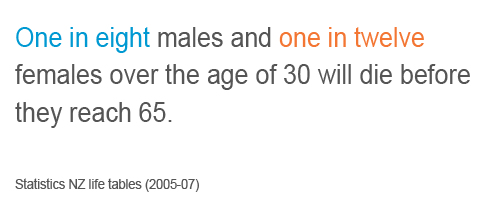

Life Insurance

Pays a lump sum if you pass away or are terminally ill. Allows family to take care of your debts at passing or simply provide family a cash payment. Additional coverage can be taken for Future Insurability etc, which covers live changing events, ie having children.

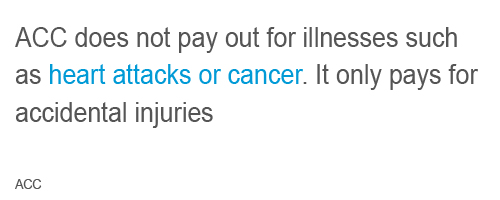

Mortgage Repayment Insurance

Takes Care of your regular mortgage repayments (up to the level you have selected) if you’re unable to work because of illness or accident. Mortgage repayment insurance ensures your home stays in your hands, even if you’re too ill to work.

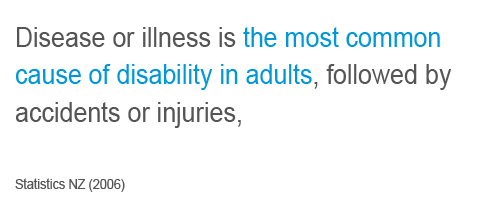

Trauma Insurance

Trauma Cover is about helping you with survival. New Zealanders are suffering an increasing incidence of cancer and we still experience high levels of heart disease and stroke. With ongoing advances in medical science, however, you have a greater chance of surviving a serious medical conditional. Trauma Cover (or Living Assurance as it’s also known) is designed to pay a lump sum to you if you suffer a critical illness, to ensure that you can cope with it’s effects on your lifestyle, family and work.

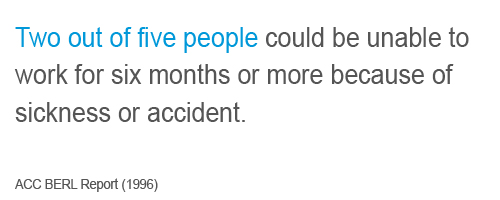

Income Protection

Pays the monthly amount (based on a percentage of income) if you are unable to work because of illness or accident. Income protection ensures you have money coming in even if you are too ill to work. The claim payment can be used for your ongoing mortgage repayments and other living costs, until you are fit to return to work, if at all.

The reality is that you should have all covers to cover any situation, but we appreciate the costs of this can be substantial. It’s our role to work out a plan and cover that suits you and your family. The key is also to take cover while young and fit, as premiums are reasonable and you will be fully covered. Should cover not be taken you run the risk of having one of the above happen to you, with no cover and no chance of applying for cover in the future.

Quick Application

Looking for more information about the services we provide? Fill in the form below and we’ll come back to you with more information as soon as possible.